Should You Invest in Argyle Pink Diamonds? What You Must Know First

Q1: Why Are Argyle Pink Diamonds So Valuable?

Argyle pink diamonds are among the rarest gemstones in the world, and their value lies in a combination of extreme scarcity, natural beauty, and iconic origin. Unlike white diamonds, pink diamonds derive their color not from trace elements, but from a rare distortion in their crystal lattice known as plastic deformation. This geological anomaly is what gives the stones their vivid pink to purplish-red hues, and it’s found in meaningful quantities only in one place on Earth: the Argyle mine in Western Australia.

Over its 37 years of operation, the Argyle mine produced more than 865 million carats of rough diamonds, yet less than 1% were pink—and only a tiny fraction of those met gem-quality standards. That’s what makes Australian pink diamonds from Argyle so coveted. Their color palette—ranging from soft blush to deep rose—is virtually impossible to replicate or mine elsewhere in such consistency.

Once the mine officially closed in late 2020, no new Argyle pink diamonds will ever be produced again. This end of supply has made them a true collector’s item, with growing demand not just in Australia, but globally—especially in Asia, Europe, and the U.S.

For serious buyers and investors, Argyle pink diamonds from Western Australia represent more than jewelry—they are tangible, finite assets backed by geological and market rarity.

Q2: What Is the Current Argyle Pink Diamond Price?

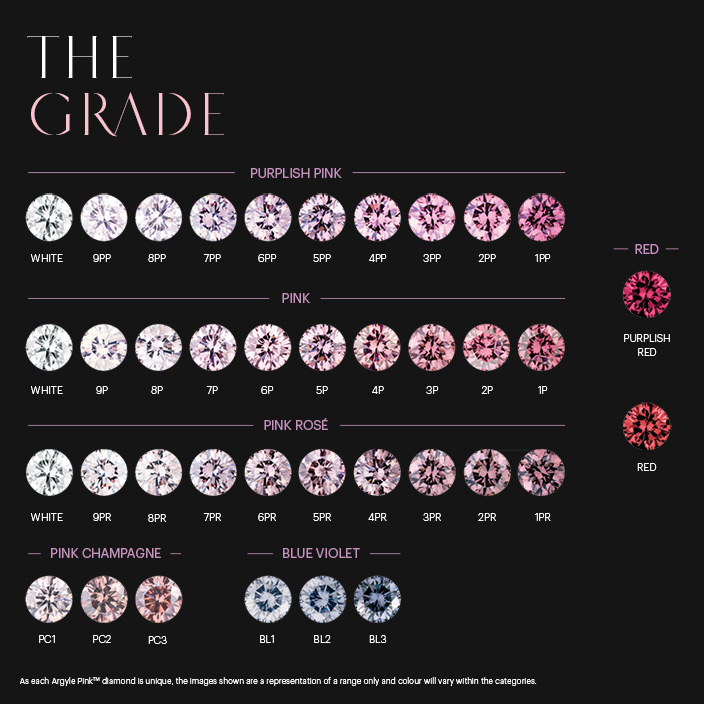

The Argyle pink diamond price depends on multiple factors:

- Color intensity (ranging from 1 to 9, with 1 being the most vivid)

- Hue modifier (pink, purplish pink, red, pink rosé, etc.)

- Carat weight and clarity

- Origin certificate from Argyle or matching laser inscription

As of 2025, here are general price indicators:

- 0.25 carat Argyle origin: AUD 40,000 up

- 0.50 carat Argyle origin: AUD 110,000 up

- 1.00 carat Argyle certified: AUD 400,000 up

Prices have risen over 70% on average since the mine’s closure, and certain rare colors (like 1PP vivid purplish pinks or reds) have doubled or tripled in value in the secondary market.

At JennyBay Diamond, we operate a Perth-based sourcing office, giving us direct access to Australia’s most trusted Argyle networks. We collaborate closely with legacy dealers and lab graders to help you secure the best quality Argyle pink diamonds at near-supplier prices—cutting out multiple layers of markup.

Q3: Is Now a Good Time to Invest in Argyle Pink Diamonds?

Yes—now is arguably the best time to invest in Argyle pink diamonds. With the Argyle mine no longer producing, supply is permanently capped. Yet demand continues to rise from collectors, luxury investors, and family offices seeking tangible, high-growth, inflation-resistant assets.

Key investment insights:

- Strong historical growth: Premium pink diamonds have seen annual appreciation of 10–15%, with some rare hues like Argyle reds seeing returns of 30%+ in select auctions and private sales.

- No synthetic substitutes: Lab-grown pink diamonds exist, but they are easily distinguishable and do not impact the pricing of natural Argyle pinks, which hold intrinsic geological and investment value.

- Global demand: High-end buyers from Hong Kong, Singapore, New York, and London continue to absorb inventory through auctions, leaving less for the Australian market.

At JennyBay Diamond, we advise investors based on real-time data, auction results, and market scarcity. Our expert team offers:

- Investment strategy based on color tier, lot history, and resale trends

- First-hand access to new releases from former Argyle site-holders

- Detailed reports and documentation to support your acquisition

Whether you’re a first-time investor or seasoned collector, securing an Australian pink diamond from Argyle is more than a purchase—it’s a legacy.

Q4: How can I be sure I’m buying a genuine Argyle pink?

Authentic Argyle pinks typically come with a laser-inscribed certification number and a certificate of authenticity from the Argyle mine or a reputable gemological lab. JennyBay Diamond works only with traceable and verifiable stones, giving our clients peace of mind when purchasing high-value assets.

Q5: Where is the best place to buy Argyle pink diamonds in Australia?

If you are serious about Argyle pink diamond investment, we do not recommend general retail outlets or commercial diamond websites. Many of these offer repolished or unverified stones at inflated prices.

Instead, choose a direct sourcing specialist like JennyBay Diamond:

- We have an office in Perth, the heart of the Argyle trade

- Our team maintains direct ties with former Argyle site-holders, labs, and major collectors

- We offer curated selections of top-grade stones for private collectors and investors

We deliver more than a diamond—we offer rare access, market insight, and long-term value.

Q6: Can I view the Argyle pink diamonds in person?

Yes. JennyBay Diamond has showrooms in Sydney, Melbourne, and Perth. Clients are welcome to schedule private appointments to view stones and discuss investment strategies. We also offer digital consultations and international shipping for verified clients.

Final Thought

When it comes to Perth Argyle pink diamonds, quality, provenance, and market insight are everything. At JennyBay Diamond, we’re proud to be Australia’s trusted name for rare pink diamond sourcing and investment.

Contact us today to explore your options. Whether you’re building a legacy or diversifying your assets, we’ll help you secure the rarest treasures from the heart of Western Australia.

More info

Investing in Pink Diamonds: Is It Worth the Sparkle?

Unlocking the Sparkle: Pink Diamonds’ Investment Potential and Market Trends