The Argyle Pink Diamond Investment Q&A (2025 Edition)

Yes — Argyle pink diamonds remain a compelling investment choice. Consistent demand combined with finite supply (following the mine closure) has made them outperform major equity markets. Additionally, even during economic downturns, they have maintained upward momentum, making them a stable, luxury-based asset.

Over the past decade, prices have doubled — increasing by an average of 116%. Going further back, from early 2000s to the mid‑2020s, price growth climbed by approximately 600%. These gains reflect strong collector interest and the end of new supply after the Argyle mine closed.

Typical price ranges (in AUD or USD equivalents) depend on intensity:

- 0.25‑ct Argyle origin stones: from around AUD 40,000

- 0.50‑ct: from approximately AUD 110,000

- 1.00‑ct certified: starting near AUD 400,000

- For broader certification categories (GIA, Argyle provenance), per‑carat prices generally range as follows:

- Fancy Light Pink: (~AUD 50k up)

- Fancy Pink: (~AUD 100k up)

- Fancy Intense Pink: (~AUD 200k up)

- Fancy Vivid Pink: (~AUD 250k up)

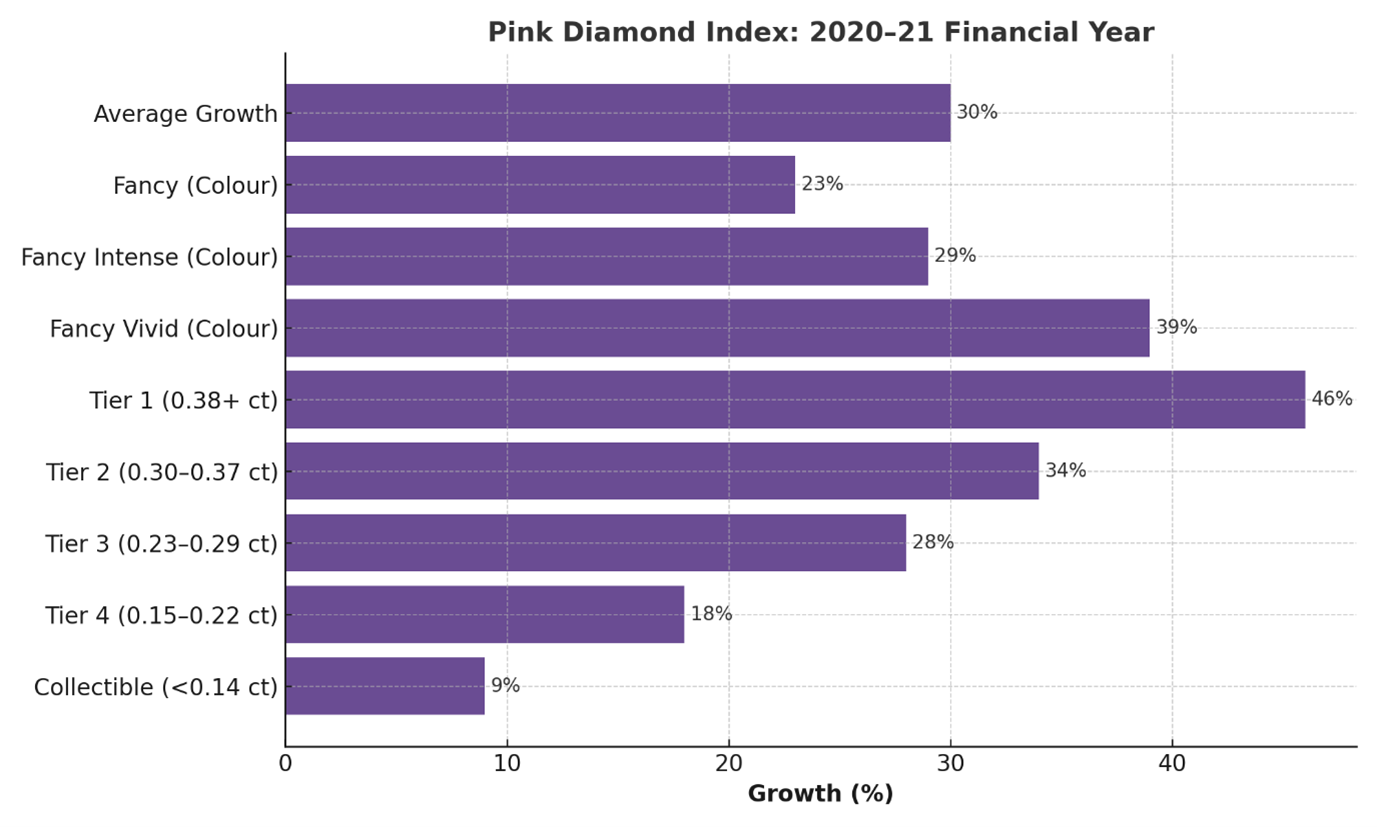

The rarer and more intense the colour, the stronger the appreciation:

- Red and purplish-pink (PP, R) categories have seen the most dramatic value increase, with some rare stones doubling or tripling in price in the secondary market since the mine closure.

- PR (rose pink) has a great future price appreciation potential

Argyle pink diamonds have outperformed not just colourless diamonds but also most fancy-colour stones:

- They have consistently exceeded the growth of blue, yellow, and white diamond indices

- Compared to elite coloured diamonds (e.g., Fancy Vivid Blue), Argyle pinks have shown superior appreciation — e.g., a 4.59‑ct Fancy Intense Pink rose from USD 115k/ct in 2003 to USD 625k/ct in 2010 (~443% growth).

High-profile auction outcomes set new market benchmarks and fuel investor demand:

- A 1.56‑carat red Argyle “Phoenix” diamond fetched USD 4.2 million at Phillips — setting a record and signaling investor appetite for top-tier stones.

- Argyle’s guided “Beyond Rare” tender collections, featuring “hero” stones, further underscore price potential in curated, invitation-only auctions.

Key drivers include:

- Rarity — A dwindling supply following the Argyle mine closure in 2020 (which ended consistent pink diamond output).

- Emotional and collector appeal — Described as akin to “modern antiquities,” with intense emotional value driving demand.

- Global demand trends — Especially strong in markets like Asia, coupled with high-end retail interest.

- Economic conditions — In times of inflation and uncertainty, tangible, rare assets like pink diamonds tend to outperform.

- Provenance & certification — The assurance of Argyle origin, GAR reports, and certification commands premium pricing.

Smaller stones have demonstrated strong price growth:

- In Q1 2022, average price gains for smaller intensities were notable — notably Fancy Intense pink stones under 0.30 ct gained ~7% in that quarter alone, often outpacing larger tiers.

- While larger stones increase more in nominal price, small stones offer accessibility and still deliver solid investment growth.

Generally yes — Fancy Vivid stones are rarer and therefore more expensive per carat:

- Pricing bands show Fancy Vivid price much higher than Intense

- However, size, clarity, and provenance can influence pricing; exceptionally rare Fancy Intense or certified stones may sometimes surpass lower-class Fancy Vivid stones.

Provenance significantly boosts resale potential:

- Stones from the Argyle Tender or those labelled as “hero” stones are highly prized due to pedigree and rarity.

- Regular Argyle-certified stones also carry premiums over generic pink diamonds because of trusted origin, with buyers paying extra for GAR documentation or laser inscriptions.

Question | Key Insight |

1. Good investment in 2025? | Yes — exceptional long-term growth, stable even in downturns |

2. 10-year price change? | +116% average; +600% since early 2000s |

3. Average per-carat price today? | 0.25‑ct Argyle origin stones: from around AUD 40,000 0.50‑ct: from approximately AUD 110,000, 1.00‑ct certified: starting near AUD 400,000

|

4. Most appreciated categories? | Red & purplish-pinks; Fancy Intense & Vivid |

5. Comparison to other coloured diamonds? | Outpaced blue, yellow markets; remarkable historic growth |

6. Impact of auctions? | Record-setting sales (e.g., Argyle Phoenix) set new benchmarks |

7. Future value drivers? | Scarcity, emotional appeal, demand, economic context, provenance |

8. Smaller vs larger sizing returns? | Smaller stones show strong percentage gains; more accessible for investors |

9. Fancy Vivid always more valuable? | Usually yes, but other factors (size, certs) can affect pricing |

10. Tender provenance effect? | Significantly higher resale values for Tender and certified stones |